Green agenda. How Russia can reduce ESG risks

There has been a public request for the development of this topic for more than a year, and in many OECD countries, the existence of a strategy and policy for managing relevant risks is as natural as, for example, the availability of permits. Nevertheless, all ESG principles are still based on the goodwill of companies, transparency and responsibility. Only a few countries currently have a developed regulatory framework in this area.

For the Russian business community, at least for companies operating in the domestic market, ESG is an exceptionally new direction, which may take more than one year to fully develop. At the same time, the vast majority of exporting companies and companies with an international ownership structure are actively implementing new values. According to PwC, more than 60% of the members of the boards of directors of companies in the Russian Federation consider the presence of an ESG policy to be a useful factor in terms of investment attractiveness (the survey was conducted in November 2019).

The main reason that companies operating in the domestic market do not pay due attention to ESG can be considered a significant difference in the perception of environmental and social problems by the end user. All costs are reflected in cost of the final product, and if the average consumer in the European Union consciously willing to pay a premium for environmentally friendly goods, in the countries of the former CIS and Russia all such expenses until fall on the company itself.

At the same time, all three risk groups are clearly differentiated by the degree of significance both at the national and international level. Today, the most urgent problems are related to the environment and climate. Since the beginning of the year, this topic has been covered repeatedly on international and local platforms. The EEF-2020 was held entirely under the "green" aegis, the President of the European Commission, Ursula von der Leyen, called for a" green deal "of the European Union, involving investments of more than 150 billion euros in "green" projects by 2030.

In the current paradigm, the way out of the crisis for the European Union will be "green", which means that all counterparties and suppliers will have to adapt to the new business environment. If earlier ESG responsibility was a voluntary vector of cooperation, then from the fall of 2020 there is every reason to expect the emergence of additional requirements in the field of ESG, which will directly affect the cost of products and access to specific markets.

Implementation

The business environment in economies with a "green" way of life has no alternative to programming economic agents for active environmental behavior. Companies from economies where the ESG agenda is not so relevant (for example, in Russia) are still in the status of catching up. Nevertheless, the "ecology" section appears in the cost structure of enterprises. Regulatory and market motivation provokes the search for solutions in the environmental infrastructure. According to the estimates of Sberbank and the Ministry of Industry and Trade, in the next 5-7 years, the share of environmental costs in the total cost structure may grow to 10-25%.

Today, national and international environmental requirements are not just a tool of market influence, it is a real problem that has a material expression:

In 12 years, the dynamics of anthropogenic climate change will become irreversible, changing the trend costs up to $1 trillion / year (IPCC, 2018)

Air pollution will directly kill 6 to 9 million people by 2060 (OECD, 2016)

Climate-related disasters cost humanity $ 520 billion a year (World Bank, 2017)

Despite the urgency of the issue, domestic industries today do not have a convenient information and business platform for "green" services to find interested buyers.

One of the few exceptions is energy: many enterprises with foreign capital and enterprises working for export are actively interested in" green " energy. For retail and automotive companies, this practice has long been the norm. The use of "green" energy reduces the total impact on the climate and has a positive impact on the attitude of customers to products (PRI, 2019). In the extractive and processing industries, this trend is still only partially present. Some companies actively use "green" energy to position their products and even create new products (for example, "Rusal-Green aluminum"). Individual industries (chemical industry, metallurgy) should switch to this model in 2021, when the requirements of foreign industry unions will begin to reflect the new realities of the" green agenda " of the OECD.

The prospects

For the Russian resource-intensive economy, environmental factors play the most serious role in terms of long-term development.

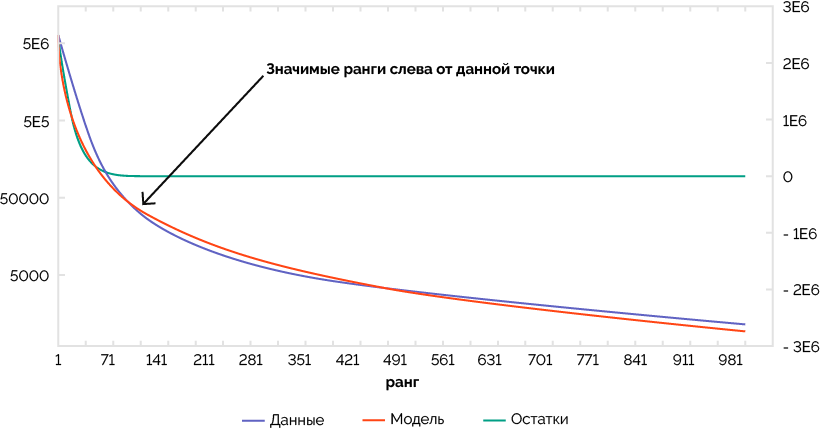

Zipfra model of the rank distribution of 3 groups of substances by chemical hazard (logarithmic form, the first 1000 values)

This form of distribution indicates a high level of clustering of enterprises on the territory of the Russian Federation in terms of the volume and composition of emissions. Low diversification by type of released pollutants (less than 60 substances) indicates a small number of emission measurements. The absolute dominance of carbon, nitrogen and sulfur compounds (in terms of type / mass ratio) in the emission spectrum indicates very primitive approaches to environmentally responsible behavior. All these factors are already affecting the competitiveness of domestic products and in the future will seriously affect the business ' resilience to crisis situations.

In order to go through the transition period of transformation consistently and at a lower cost, it is necessary to clearly set priorities and have a clear strategy with fixed key points. Measures to contain changes and adapt to climate change need to be seriously discussed, while environmental problems in the country need to be addressed today.

Sberbank, as the owner of Russia's largest corporate loan portfolio, has already identified the risks associated with the ESG agenda, and today is developing and piloting special "green" products aimed at solving environmental problems for industrial customers — the most problematic area of today's environmental agenda in Russia.

In the future, it is planned to implement both financial and non-financial services within the bank's ecosystem, aimed at increasing the attractiveness of environmental projects for customers and supporting the transition to a sustainable economy for any enterprises operating both on the external and domestic markets.

Source: https://sber.pro/publication/zelenaia-povestka-kak-rossii-snizit-esg-riski